Article courtesy of Genworth Canada. Land transfer tax. When a home changes hands, many provinces and a few municipalities charge a property transfer tax or title transfer fee. Rates are usually on a scale of 0.5% to 2% of the home’s value and can add thousands to your purchase price. First-time homebuyers qualify for rebates… Continue reading 10 Closing Costs When Buying a Home

Going digital

In Ontario, all real estate transactions are done through the electronic registration database, otherwise known as Teraview. Everything is done electronically: preparing deeds and mortgages, signing them, and registering them. So why do you have to sign so much paper when you are buying or selling a house? The main issue is being able to… Continue reading Going digital

Mortgage Monday Rate Update – August 2012

Whether you like it or not, stats and numbers are a part of the world of mortgages. When rates change even the slightest of percentage points, it could cost or save you thousands of dollars. Every once in a while, here on the Mortgage Monday posts, I’ll update you on what’s going on in the world of mortgage… Continue reading Mortgage Monday Rate Update – August 2012

Choose wisely

Today, I thought I would blog about something that’s been taking over my life a bit lately: the busy summer season and choosing your closing date. It is traditional for real estate to be busy in the summer; people frequently go house hunting in the spring once the weather turns nice, and the deals close… Continue reading Choose wisely

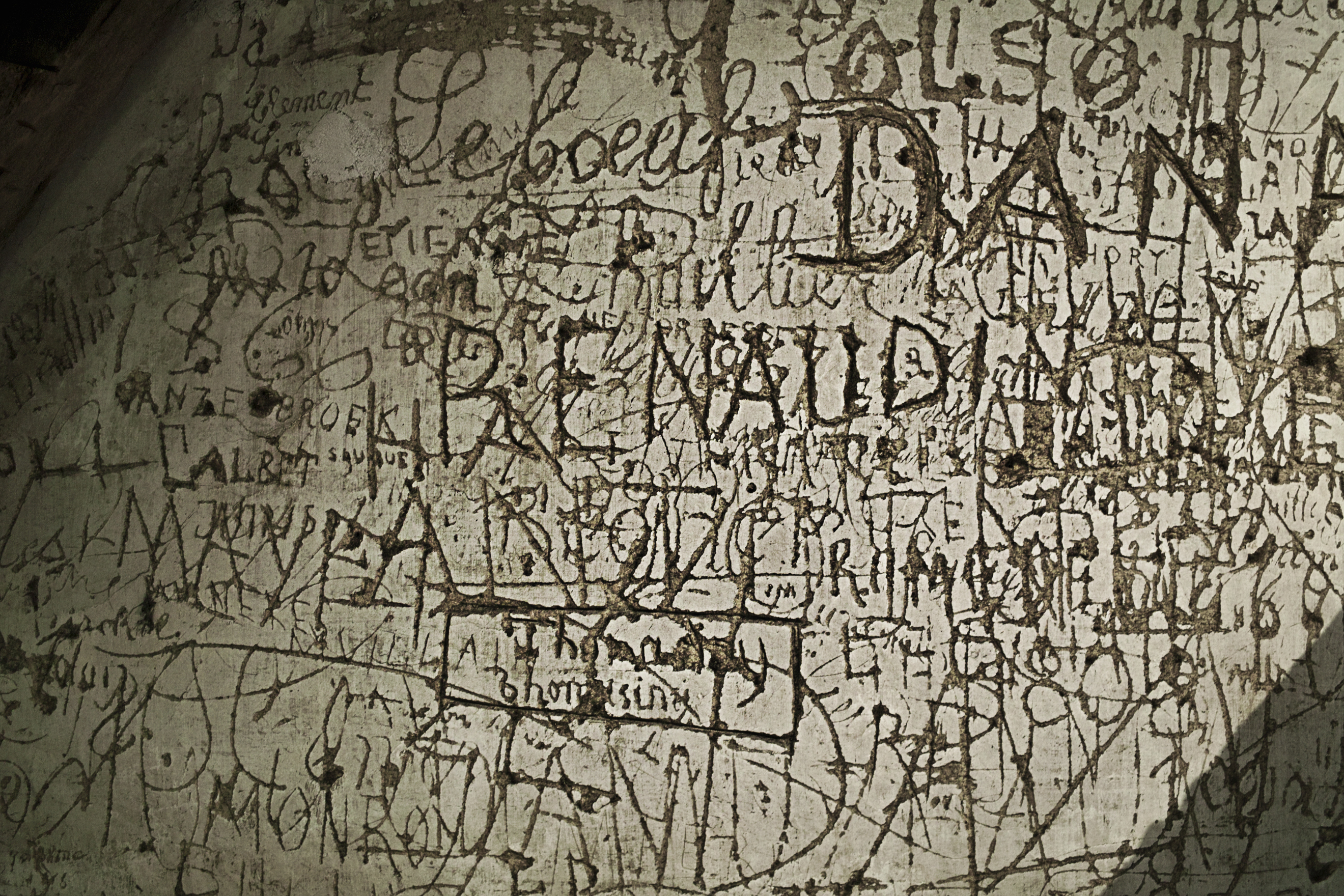

The Writing’s on the Wall for the 80% HELOC

If you’ve been holding off looking into a readvanceable mortgage or HELOC (Home Equity Line of Credit) and are looking to use up to 80% of your home value, you’re running out of time to get it done. The new underwriting mortgage rules (that we looked at a couple of months ago) that were brought… Continue reading The Writing’s on the Wall for the 80% HELOC